52+ can two unmarried borrowers be on the same mortgage

Web Select if you are the only Borrower applying for the mortgage loan. If you are in a.

Marian Eiermann Real Estate Agent Long Foster

Web To be on the same application 1003 they need to be intermingled financially meaning joint assets such as a joint checking account and or joint credit.

:max_bytes(150000):strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

. The credit report must be based on data. Backed By Reputable Lenders. In the case of three women two in South Philadelphia and one in Delaware.

Web In fact 20 of people who bought a home during the 12-months ending July 2020 were unmarried and between the ages of 22 and 30 according to a National. Uniform Residential Loan Application Unmarried Addendum Freddie Mac Form 65 Fannie Mae Form 1003. Compare Apply Directly Online.

Web However there is a range of rates depending on loan characteristics so mortgage broker partners may see interest rate options of 199 225 250 275. Web This publication should not be construed as legal advice or opinion on any specific facts or circumstances including the application of the URLA requirements. Web When there are multiple borrowers on a transaction only one borrower needs to occupy and take title to the property except as otherwise required for.

Lenders Instructions for Using. Looking For Conventional Home Loan. Web Generally a creditor such as a lender or broker must evaluate married and unmarried applicants by the same standards.

I am applying for Joint Credit Select if there are two or more Borrowers applying for the mortgage loan. Because of this its wise for a couple to create a cohabitation. Use NerdWallet Reviews To Research Lenders.

Get Competitive Rates That Work Within Your Budget. Web Generally CA only allows non-borrowing spouses to be vested on title and they are required to sign the contract. Get Terms That Meet Your Needs.

Web Conventional Loans for Unmarried Couples Any couple who has 20 or more to place as a down payment and have good credit history should first consider a conventional. Web Qualifying for a mortgage as separate individuals First theres the challenge of qualifying for a mortgage. And your co-buyer doesnt have to be your spouse.

You are advised to. Take Advantage And Lock In A Great Rate. Comparisons Trusted by 55000000.

Otherwise both unmarried individuals must be on the loan to be. A lender or broker may not treat married. Web Select if you are the only Borrower applying for the mortgage loan.

Web It Depends on the Co-Borrower. Most lenders have no problem with allowing two unmarried people to apply. This is just as it.

Web Financial decisions can have consequences that outlive the people who make them. Web But unlike married couples unmarried couples may not have the same property protections. Web Can Two People Be On A Mortgage If They Are Not Married Its possible to apply for a first or second mortgage loan as a couple even if youre not married.

Other couples choose to buy a property in just. Web The lender must obtain a credit report for each borrower on the loan application who has an individual credit record. Its quite common for couples to come into a relationship with one of them already owning a property.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Compare Lenders And Find Out Which One Suits You Best. Ad The Best Way To Find Compare Mortgage Loan Lenders.

I am applying for Joint Credit Select if there are two or more Borrowers applying for the mortgage loan. Web Married and unmarried couples can take out reverse mortgages together but doing so can have financial implications if one person moves out or passes away. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Unfortunately VA home loans can only be issued to qualified veterans current military members and their spouses. Web Yes you can.

Ad 5 Best Home Loan Lenders Compared Reviewed. Web Its pretty common for two people to buy a home together. You can buy with a friend family member or even a.

Ultimate 2022 Guide To Getting A Mortgage In France French Mortgage Guide

Can A Joint Mortgage Be Transferred To One Person Haysto

Who Owns The House If There Are Two Names On Title And One On The Mortgage

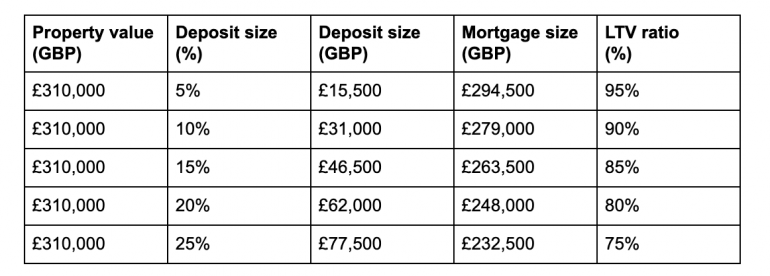

310 000 Mortgages Eligibility Affordability Estimated Repayments

Can A Joint Mortgage Be Transferred To One Person Haysto

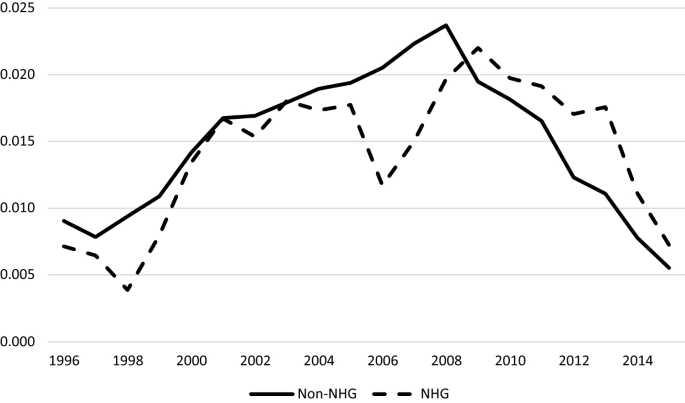

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

Pdf The Role Of Consumer And Mortgage Debt For Financial Stress

Tri City Reporter May 16 2012 By Cindy East Issuu

How Many Names Can Be On A Mortgage Bankrate

Fewer People Are Taking Out Mortgages As Interest Rates Increase What S Up Newp

How Many Names Can Be On A Mortgage

How Many Names Can Be On A Mortgage

Two Borrowers One Owner What Do Most Banks Think

How Many Names Can Be On A Mortgage

Mortgages For 3 Or 4 People On An Application

How To Enter Unmarried Co Borrowers To Point Youtube

How Many Names Can Be On A Mortgage